Revolutionizing Financial Markets: The Power of Automated Trading

The world of finance has witnessed a profound transformation in recent years with the rise of automated trading. This technological revolution has not only reshaped the way financial markets operate but has also democratized access to trading, making it more efficient and accessible to a broader range of investors. Automated trading, often referred to as algorithmic trading or algo-trading, leverages computer programs and mathematical models to execute orders at high speeds and frequencies. In this article, we will delve into the world of automated trading, exploring its origins, mechanisms, advantages, and potential risks.

The Evolution of Automated Trading

Automated trading systems are not a recent development; they have been evolving for several decades. However, their widespread adoption and the advancement of technology have accelerated their growth in recent years. The roots of automated trading can be traced back to the 1970s when financial institutions began using computer programs to execute simple trading strategies. These early systems laid the foundation for what would eventually become highly complex and sophisticated trading algorithms.

Mechanisms of Automated Trading

Algorithm Development: Automated trading begins with the development of trading algorithms. These algorithms are sets of predefined rules that dictate when to buy or sell a financial instrument. They are developed using a combination of historical market data, technical indicators, and mathematical models.

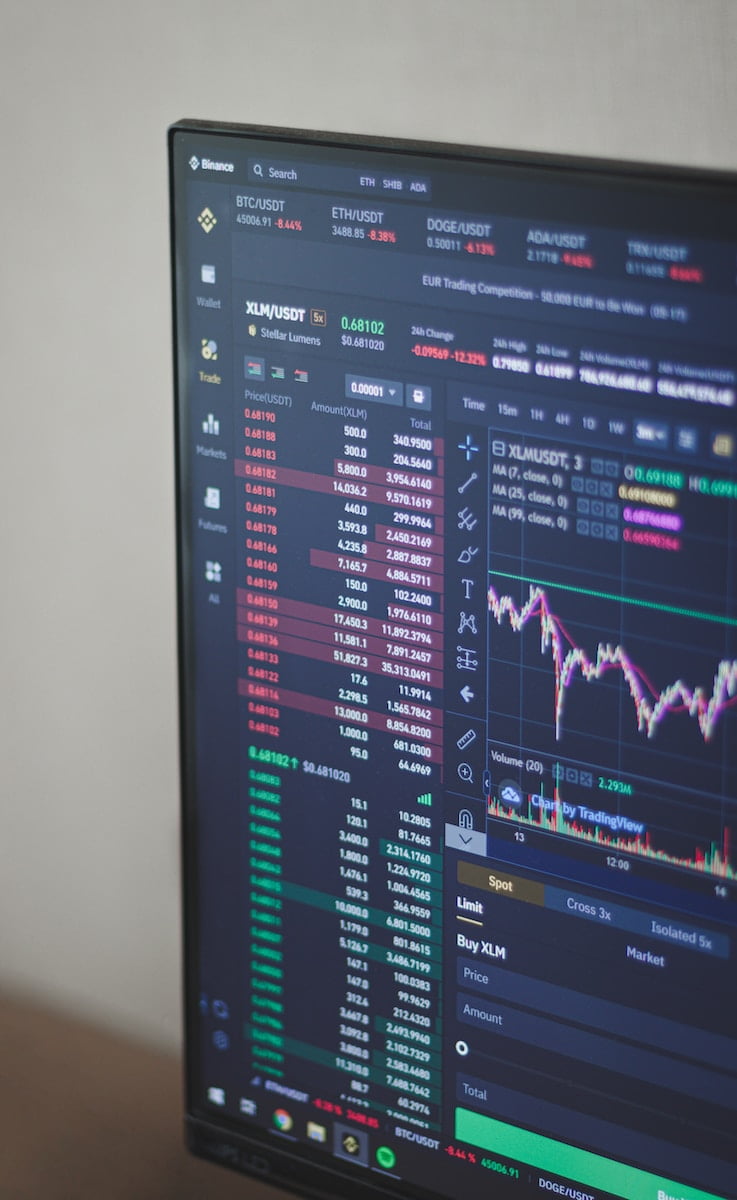

Data Analysis: To make informed decisions, automated trading systems rely on vast amounts of data. This includes real-time market data, historical price charts, news feeds, and more. Advanced algorithms analyze this data to identify trading opportunities.

Risk Management: Effective risk management is crucial in automated trading. Algorithms are designed to manage risk by setting stop-loss orders, position sizing, and other risk control measures to protect the trader from significant losses.

Execution: Once a trading opportunity is identified, the automated system swiftly executes the trade. This is often done within milliseconds, taking advantage of price discrepancies that might only exist for a brief moment.

Advantages of Automated Trading

Speed and Efficiency: One of the most significant advantages of automated trading is speed. Algorithms can execute trades in a fraction of a second, far faster than any human trader. This speed allows traders to take advantage of short-lived opportunities and react to market changes swiftly.

Elimination of Emotional Bias: Human traders are susceptible to emotional biases, such as fear and greed, which can lead to poor decision-making. Automated trading eliminates these biases, as algorithms operate purely based on data and predefined rules.

Diversification: Automated systems can manage multiple trades and strategies simultaneously. This diversification reduces the risk associated with having all investments in a single asset or strategy.

Backtesting and Optimization: Traders can thoroughly test and optimize their trading algorithms using historical data. This helps in fine-tuning strategies for better performance.

Continuous Monitoring: Automated systems can monitor the markets 24/7, allowing traders to capitalize on global opportunities and respond to news and events as they unfold.

Potential Risks and Challenges

While automated trading offers numerous advantages, it is not without its risks and challenges:

Technical Issues: System failures, connectivity problems, and software bugs can lead to unexpected losses. It’s crucial to have robust backup systems in place.

Over-Optimization: Over-optimizing algorithms for past data can lead to poor performance in real-market conditions.

Market Volatility: Rapid market changes can trigger a cascade of trades, exacerbating market volatility. This can lead to unexpected losses in highly volatile situations.

Regulatory Compliance: Automated traders must navigate a complex web of regulations, which can vary by region and asset class.

Lack of Human Oversight: Relying solely on automated systems without human oversight can be risky. Traders should be prepared to intervene when necessary.

Conclusion

Automated trading has fundamentally transformed financial markets, offering unprecedented speed, efficiency, and access. While it provides numerous advantages, it also comes with risks that require careful management. As technology continues to advance and algorithms become more sophisticated, automated trading is likely to play an increasingly prominent role in the global financial landscape. Investors and traders must stay informed and adapt to this ever-evolving field to harness its full potential while mitigating its risks.

+ There are no comments

Add yours