Trading platforms have undergone a remarkable transformation over the years. They have evolved from traditional trading floors to cutting-edge digital interfaces that empower individuals and institutions to access global financial markets with ease. In this article, we will explore the evolution of trading platforms and their significance in the modern world of finance.

The Early Days

Before the advent of electronic trading platforms, financial markets relied heavily on open outcry systems where traders physically gathered on trading floors to exchange securities. This method was slow, prone to human error, and limited by geographic constraints. The trading landscape underwent a paradigm shift with the introduction of electronic trading platforms.

Electronic Trading Platforms

The 1980s saw the emergence of electronic trading platforms, allowing traders to execute orders electronically. This innovation significantly improved market efficiency, transparency, and accessibility. Early systems like NASDAQ and the NYSE’s SuperDOT paved the way for the digital revolution in trading.

Online Brokerage Firms

The late 1990s brought the rise of online brokerage firms, enabling retail investors to access markets from their computers. These firms offered user-friendly platforms and educational resources, democratizing trading by making it accessible to a broader audience.

The Dawn of Algorithmic Trading

The 21st century witnessed the rise of algorithmic trading, enabled by advanced trading platforms. Algorithms could execute complex trading strategies with speed and precision, leading to increased liquidity and reduced trading costs. High-frequency trading (HFT) became a dominant force in financial markets.

Multi-Asset Trading Platforms

Modern trading platforms have evolved into versatile tools that cater to a wide range of assets, including stocks, bonds, commodities, forex, cryptocurrencies, and derivatives. Traders can diversify their portfolios and manage risk more effectively through a single interface.

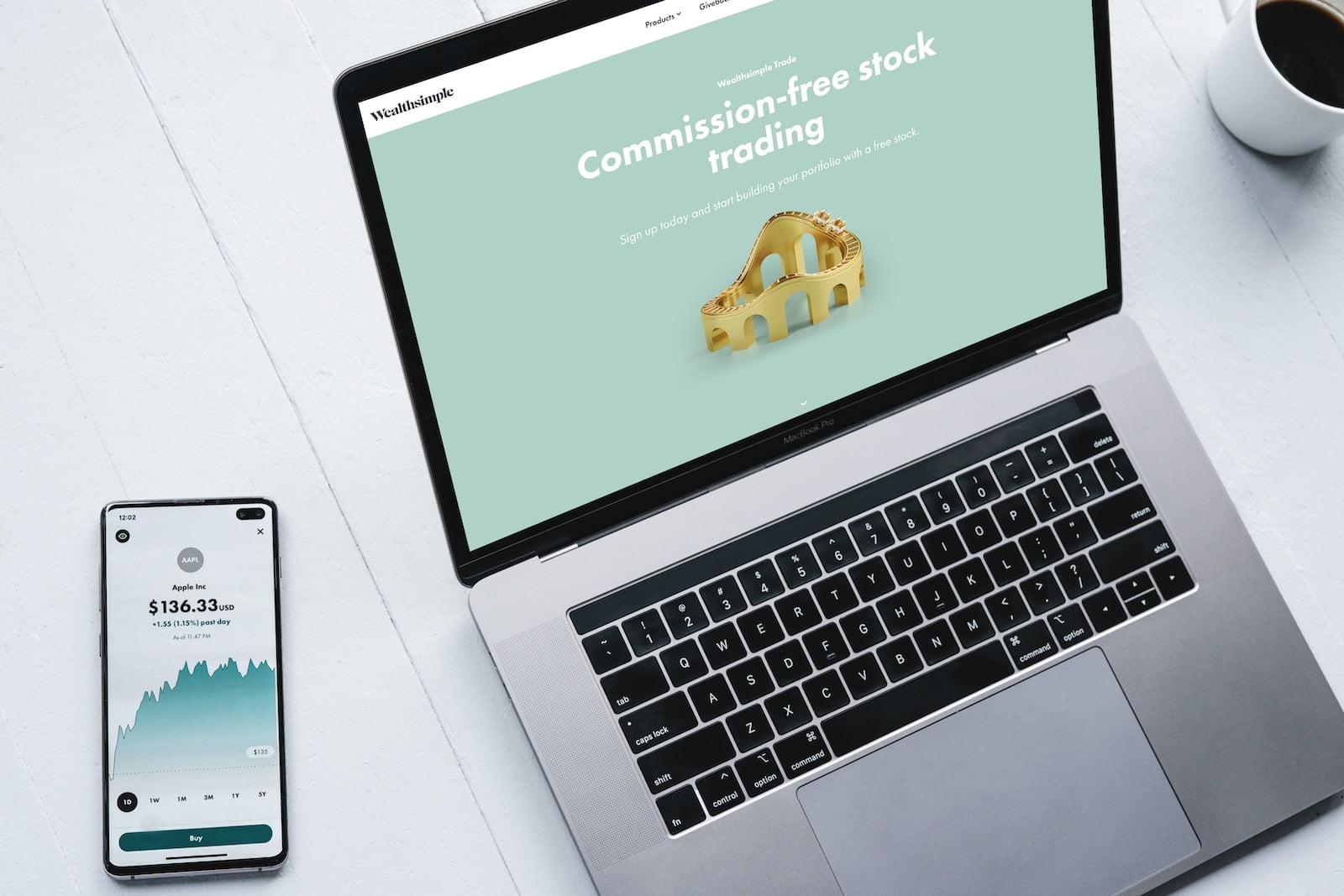

Mobile Trading Apps

With the proliferation of smartphones, mobile trading apps have become indispensable tools for traders on the go. These apps provide real-time market data, news, and the ability to execute trades from the palm of your hand. They have further democratized trading, making it accessible to anyone with a smartphone.

Social Trading and Copy Trading

In recent years, social trading and copy trading have gained popularity. These features allow traders to follow and replicate the strategies of experienced traders. It’s a way for newcomers to learn from experts and for experts to earn additional income by sharing their trades.

The Importance of User Experience

As trading platforms have evolved, the user experience has become a central focus. Intuitive interfaces, advanced charting tools, and customizable dashboards have enhanced traders’ ability to analyze markets and make informed decisions.

Security and Regulation

The security of trading platforms has also improved significantly. Robust encryption, two-factor authentication, and regulatory oversight ensure the safety of funds and sensitive information. Regulatory bodies like the SEC and CFTC oversee trading platforms to protect investors and maintain market integrity.

Trading platforms have come a long way from the days of open outcry trading. They have evolved into powerful tools that democratize access to global financial markets, empower traders with advanced technology, and provide a wide range of assets to trade. As technology continues to advance, trading platforms will likely continue to evolve, shaping the future of finance and investment. Whether you’re a seasoned trader or a novice investor, a reliable trading platform is your gateway to financial success in the modern world.

+ There are no comments

Add yours